-40%

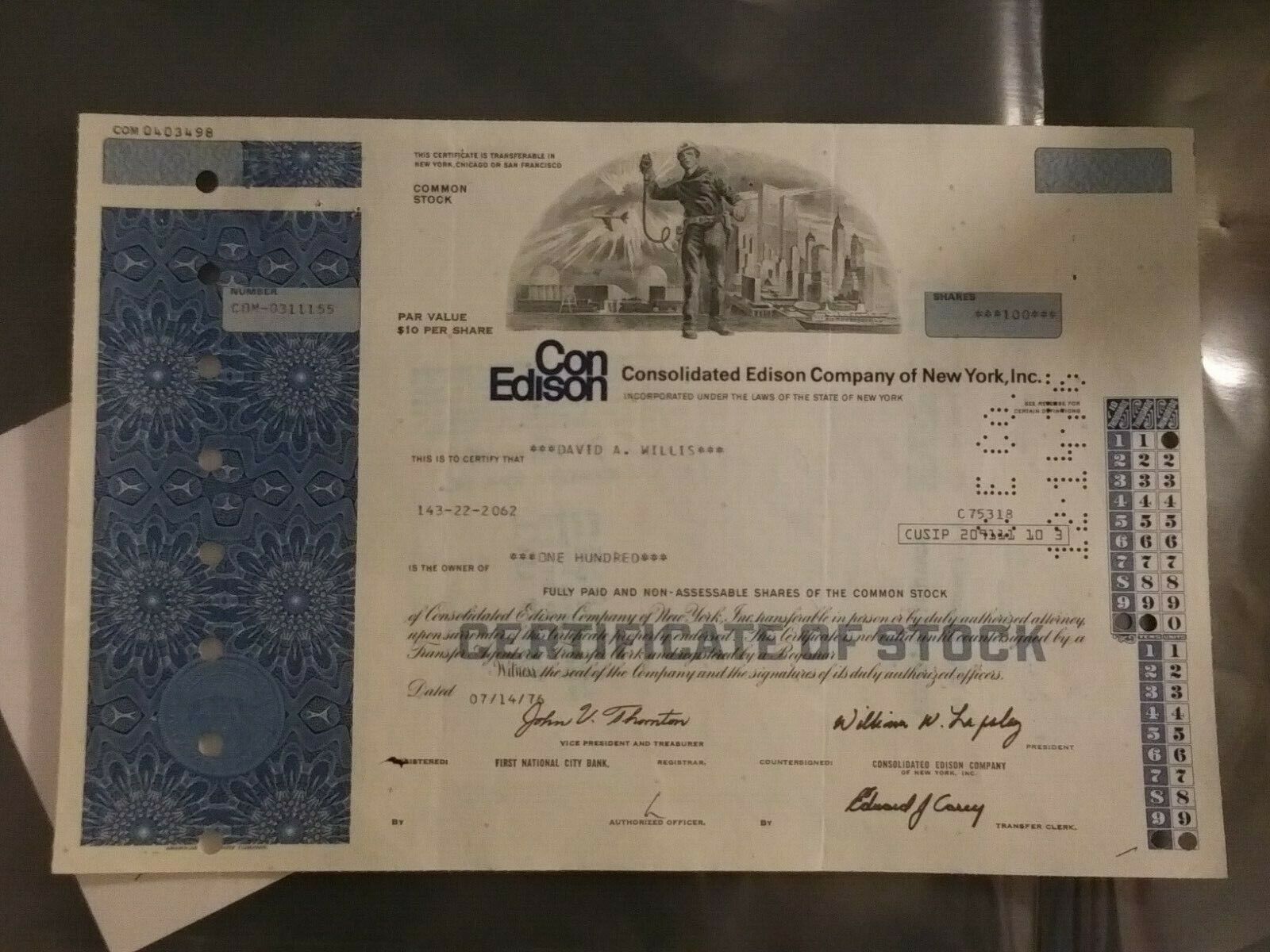

Pennsylvania Power + Light Company Old 10 Share Stock Certificate

$ 13.2

- Description

- Size Guide

Description

Pennsylvania Power & Light Company stock certificate specimenVery nice collectible PPL common stock. Very nice vignette of multiple allegorical Greek figures. Issued and cancelled. Dated in the 1970s.

The PPL Corporation is an energy company headquartered in Allentown, Pennsylvania, USA. It currently controls about 8,000 megawatts of regulated electric generating capacity in the United States and delivers electricity to 10.5 million customers in Pennsylvania, Kentucky, and Great Britain. It also provides natural gas delivery service to 321,000 customers in Kentucky. PPL Electric Utilities (formerly known as PP&L and Pennsylvania Power and Light) is the PPL Corporation's primary subsidiary. The majority of PPL's power plants burn coal, oil, or natural gas. PPL also owns peaking plants, which require few operators and have a high profit margin due to their ability to rapidly come online when the price of electricity spikes.

Pennsylvania Power & Light was founded in 1920 out of a merger of eight smaller Pennsylvania utilities. It gradually extended its service territory to a crescent-shaped region of central and northeastern Pennsylvania stretching from Lancaster, through the Lehigh Valley into Scranton and Wilkes-Barre. In 1995, it reorganized as a holding company, PP&L Resources, which changed its name to the current PPL Corporation in 2000.

The company limited its activities to Pennsylvania until deregulation of electrical utilities in the 1990s encouraged PPL to purchase assets in other states. The largest of these transactions was PPL's 1998 purchase of 13 plants from Montana Power (leaving NorthWestern Energy - the buyer of the former Montana Power transmission and distribution systems - vulnerable to high "spot" prices on the energy market). This added over 2,500 MW of capacity and was the largest expansion in PPL's history. In 2014, those hydroelectric facilities were sold to NorthWestern.

In May 2002, PPL announced that Robert G. Byram, PPL's chief nuclear officer since 1997, was retiring from the company. Bryce L. Shriver, who had served as vice president-Nuclear Site Operations at PPL's Susquehanna plant since 2000, became senior vice president and chief nuclear officer. PPL's 2008 revenue was .2 billion, with a net profit of 0 million, making it number 314 on the 2009 Fortune 500 list. After acquiring Central Networks and LG&E, PPL's 2011 profit rose to .495 billion, on .7 billion in revenue, ranking it number 212 on Fortune's 2012 list.

In March 2011, PPL acquired from E.ON the British distribution company Central Networks for £3.5 billion.

On June 6, 2014, PPL announced it will be divesting its electrical generation facilities to a newly formed company, Talen Energy. On June 1, 2015, the Talen spinoff was completed, allowing PPL to concentrate on the transmission and distribution aspects of the electric utility business.

On July 1, 2016, PPL Solutions, LLC was sold to Hansen Technologies Limited. PPL Solutions provides billing, business process outsourcing, call center, and information technology services to regulated utilities in the United States.