-40%

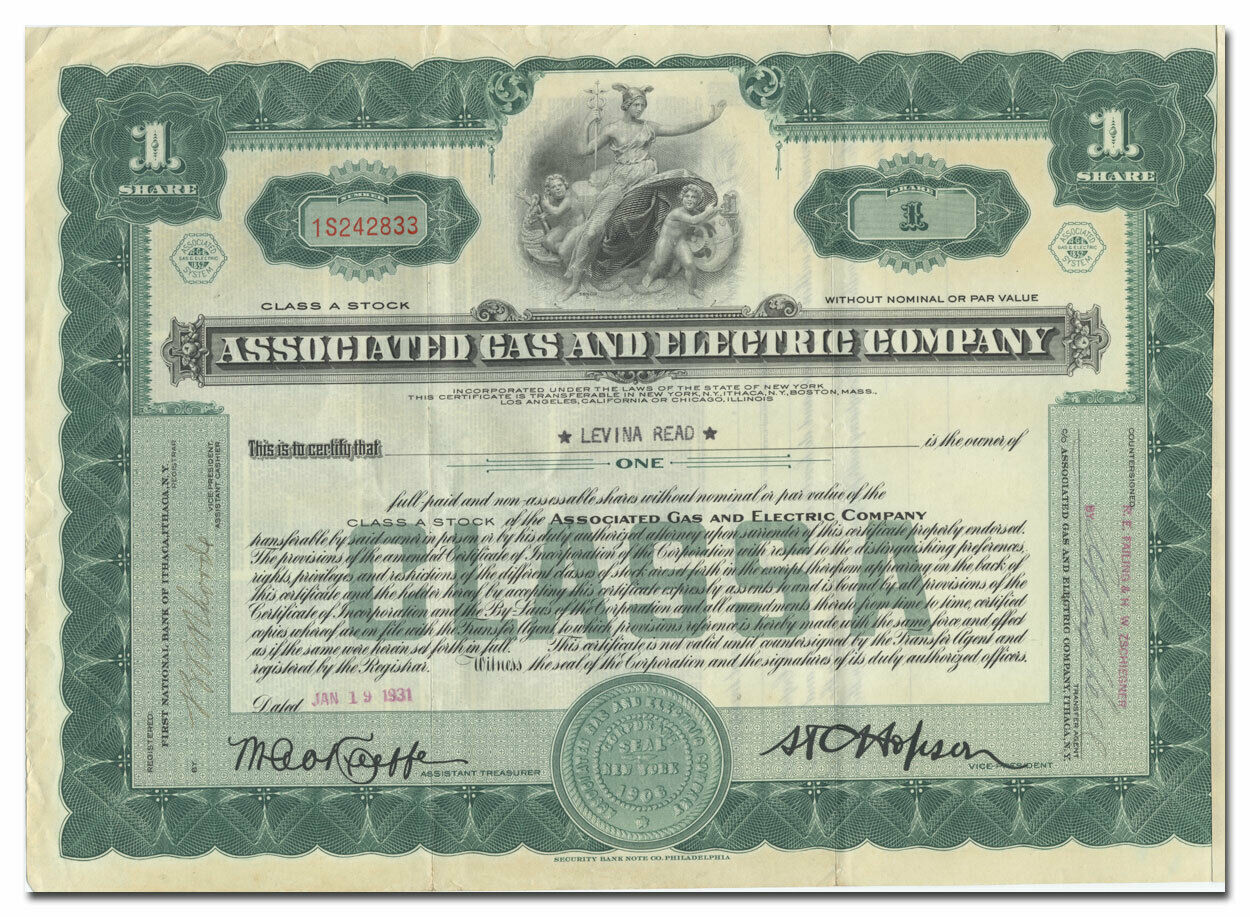

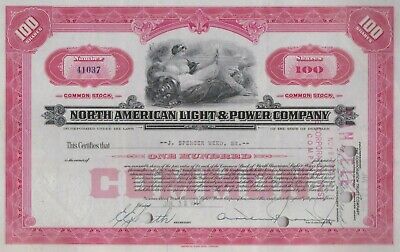

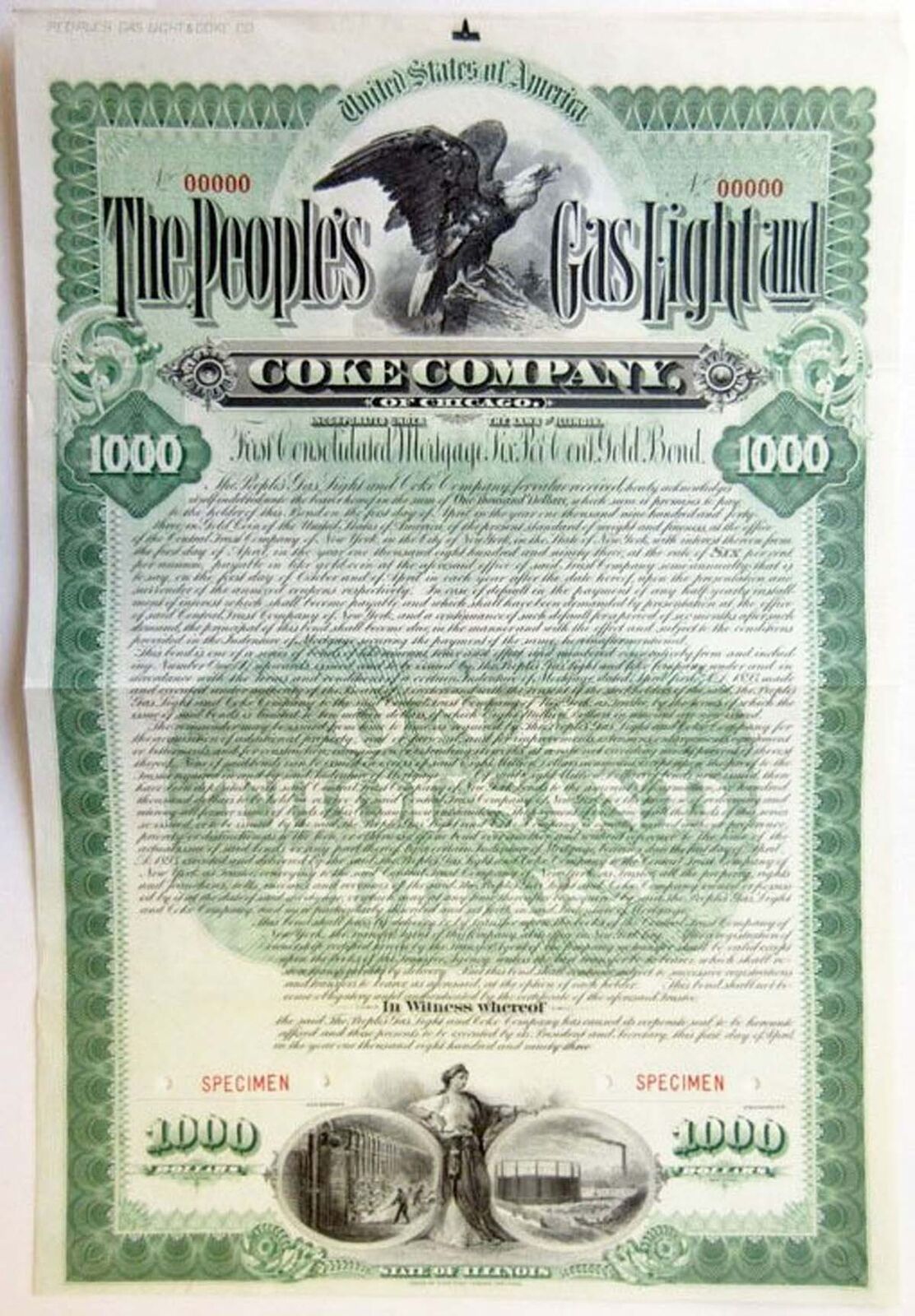

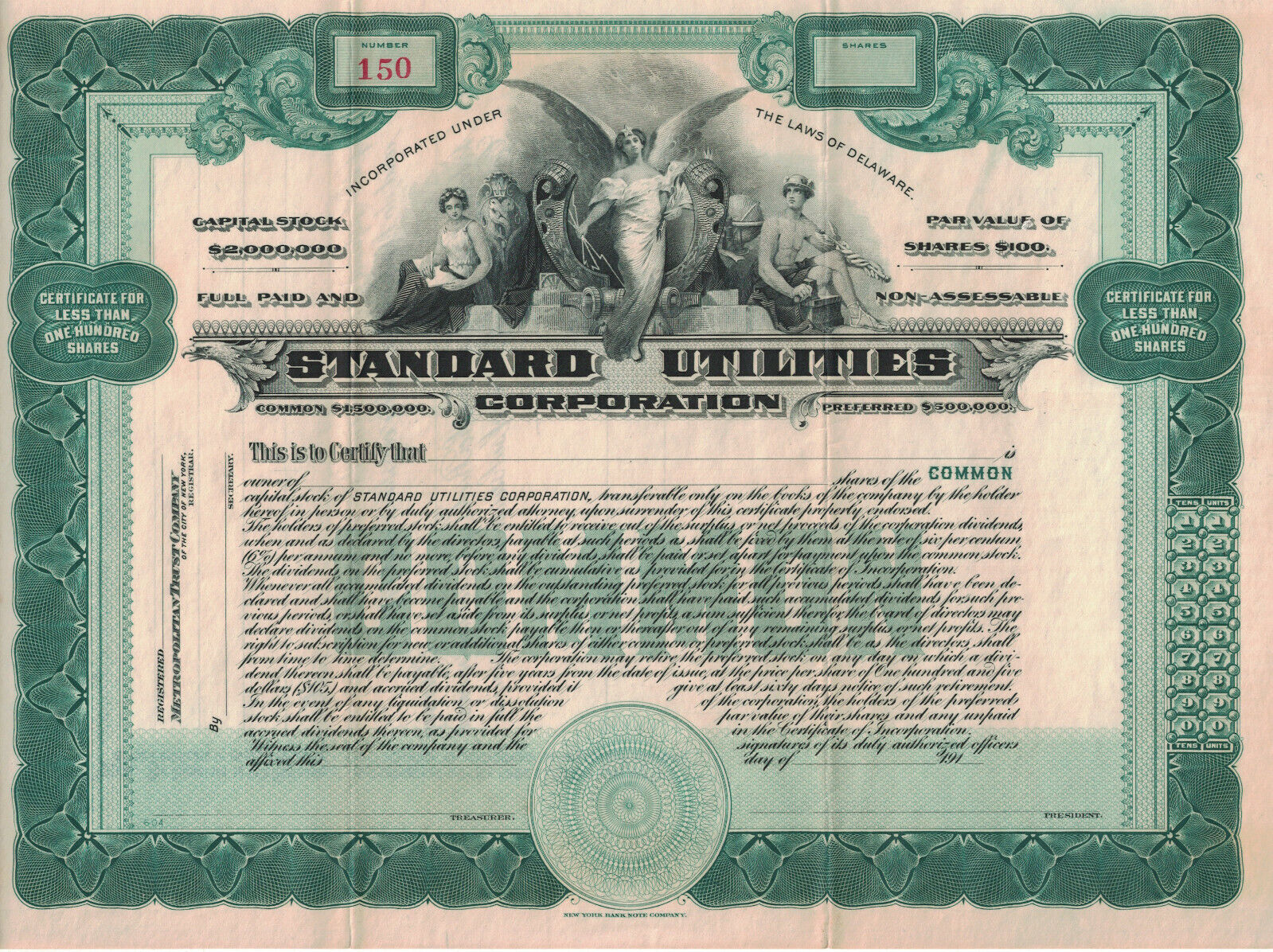

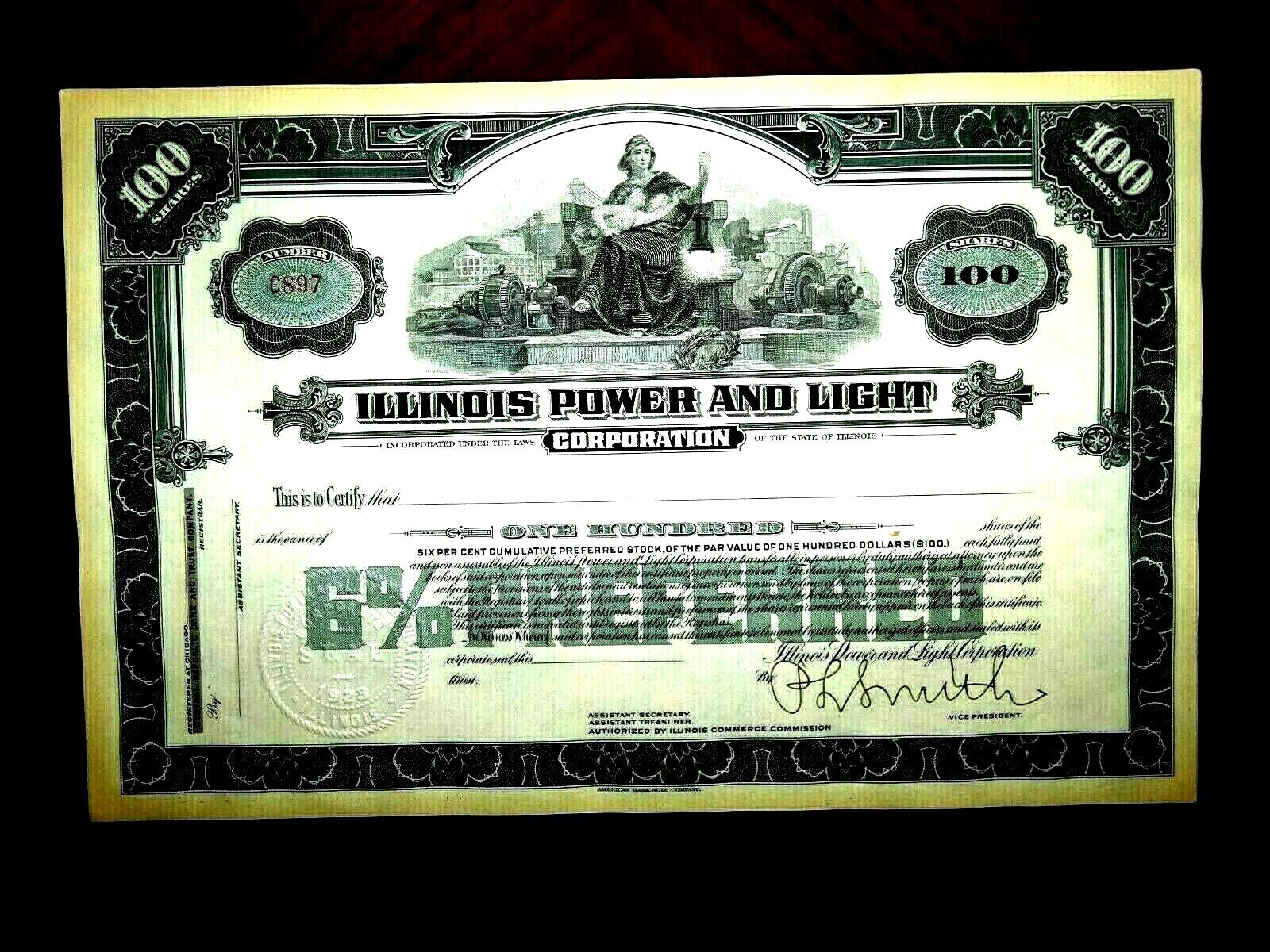

Associated Gas and Electric Company Stock Certificate (Neat Vignette!)

$ 2.1

- Description

- Size Guide

Description

Associated Gas and Electric Company Stock CertificateThis piece is an Ebay exclusive. We are only offering this piece here!

The Associated Gas & Electric Company (Ageco) was originally incorporated in 1906. A group of small-town promoters around Ithaca, New York, created Ageco as a holding company for 12 small gas and electric properties: ten in south central New York and one each in Pennsylvania and Ohio. The total value of the properties was .2 million. In spite of some minor acquisitions over the next several years, Ageco remained a group of small, rural New York companies as late as 1921, with assets under million. In 1922, however, Ageco entered a period of almost two decades of dramatic growth tied in with incredibly convoluted and often illicit financial manipulations.

In 1908 at the age of 26, Howard C. Hopson had been hired by the New York State Public Service Commission as chief of its division of capitalization. In this position, Hopson was a central figure in New York state public utility regulation from 1908 to 1915. Here he met John I. Mange, general manager of Ageco and president of several of its operating subsidiaries. Hopson and Mange became close friends. In 1915 Hopson left the commission to become an independent consultant. In 1922, through an amazing series of transactions involving dummy companies, Hopson and Mange bought all the stock in Ageco. With the pair now firmly in power, Mange became president of Ageco, and Hopson became treasurer and vice president. The expansion that followed turned Ageco into a utilities giant, including about 180 intricately connected subsidiaries and service companies, possessing properties in 26 states and in the Philippines.

By 1924 Ageco's assets were up to million, and more than tripled to 7 million in 1925. The most significant acquisitions of this period were the Pennsylvania Electric Corporation and the Manila Electric Company. Hopson funded these purchases by issuing the first of several unusual types of convertible securities that were to become his standard operating method. Hopson's method involved complex juggling of assets between holding companies and subholding companies. The process was so complicated that accountants, lawyers, and shareholders could not follow it, enabling Hopson to derive huge sums from the system by way of his personally held service companies, which performed various tasks for the operating companies and charged them outrageous rates. In the three years preceding the stock market crash of 1929, Hopson sold nearly 0 million worth of Ageco debentures convertible to stock. Because stock prices were rising so fast during this time, people were anxious to exercise these conversion rights and bought up the bonds quickly. Ageco ended 1929 as one of the five largest holding-companies in the nation. With the collapse of the stock market, however, Hopson was no longer able to support Ageco's pyramid-like structure through the sale of new securities.

By 1932 Ageco was in a desperate situation. The Depression had slowed revenue growth of the operating companies, and Ageco had difficulty raising money to pay off maturing bonds. In an effort to save his empire, Hopson announced in early 1932 that over the last few years all of Ageco's income-producing assets had been shifted into a subsidiary, Associated Gas & Electric Corporation (Agecorp), formerly called Associated Utilities Investment Corporation. Ageco security holders suddenly discovered that their stock was subordinate to any debt that Agecorp might create.

Then, in a further attempt to avoid bankruptcy, Hopson unveiled his plan for recapitalization, in 1933. Under the plan, investors were given the option of exchanging their Ageco debentures for Agecorp securities. The catch was that they would have to take either a 50 percent reduction in their principal amount, or retain their principal and accept a significant cut in interest rate.

Although the recapitalization plan was somewhat successful as a stalling tactic, a group of security holders attempted to force Ageco into receivership. This litigation and similar legal attacks lasted until 1937, when a compromise was struck. The compromise required Hopson to appoint three independent directors to his board to help work out a more equitable reorganization plan and to protect the shareholders' interests. At the same time as this battle raged, the Treasury Department was trying to collect million in back taxes from Ageco. Throughout these attacks Hopson personally continued to fare very well financially. He and his family collected at least .6 million between 1934 and 1938 from the service companies alone.

Meanwhile, Congress had begun its work on the Public Utility Holding Company Act, passed in 1935. Hopson's furious lobbying against the act helped to make him a target for investigation by the Securities and Exchange Commission (SEC) and other federal agencies. In the course of its investigation, the SEC put a halt to certain illegal accounting practices used by Ageco and Agecorp, and both companies filed for bankruptcy in January 1940. Hopson himself eventually was convicted of mail fraud and sentenced to five years in prison.

The reorganization that followed bankruptcy was a success. The reorganization staff included Albert F. Tegen, who had served on the SEC investigation team and then became president of Ageco, and Willard Thorp, a leading economist, who became chairman of the board. During this period of trusteeship, creditors received Ageco stock, claims were settled, reduced power rates improved customer relations, the tangle of securities and holdings was simplified, and million a year in interest savings was filtered back into previously delayed maintenance and new construction projects. By 1945 Ageco stock was six times as high as it had been in 1942, and the new streamlined Ageco was the pride of the SEC. The company's name was changed in 1946 to General Public Utilities Corporation.

Frequently Asked Questions:

Is the certificate in this listing, the exact piece I will receive?

For this listing - no, t

he images are representative. We do this when multiple quantities are being offfered. You will receive a certificate in similar condition; however dating, denomination, certificate number and issuance details may vary.

Is this document authentic or a reproduction?

All pieces we offer are originals - we do not sell reproductions. If you ever find one of our pieces not to be authentic, it may be returned at any time.

Can this certificate be cashed in?

All of our certificates are sold only as collectible pieces, as they are either canceled or obsolete. Certificates carry no value on any of today's financial indexes and no transfer of ownership is implied.

Do you combine shipping?

We offer flat rate shipping - whether you order 1 certificate or 100 - you pay only the published flat rate.

To take advantage of our flat rate shipping offer,

you must add all of the pieces you would like to your eBay cart

and perform a single checkout. If you use "Buy It Now" for each individual certificate, you will be charged a shipping charge each time - this is a limitation of the eBay system.

Is all of your inventory on eBay?

Absolutely not! We have 1,000s of certificates on our website.